How Many Drilling Rigs Are Operating in the US in 2026

This data-driven guide explains how many drilling rigs are active in the US in 2026, with onshore/offshore splits, regional patterns, and how to read rig-count data for DIYers and professionals.

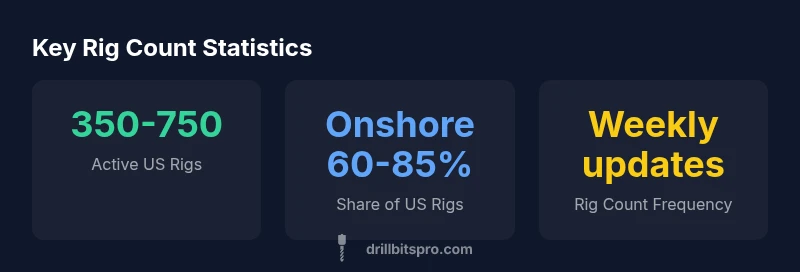

Active drilling rigs in the United States fluctuate weekly, but current estimates place the range between 350 and 750 rigs, with most located onshore and a smaller offshore component. This broad range reflects price cycles, regional demand, and seasonal activity. Drill Bits Pro Analysis, 2026 uses Baker Hughes data and EIA context to frame this dynamic for professionals.

Understanding the Landscape

Active drilling rigs in the United States fluctuate weekly, but current estimates place the range between 350 and 750 rigs, with most located onshore and a smaller offshore component. This broad range reflects price cycles, regional demand, and seasonal activity. Drill Bits Pro Analysis, 2026 uses Baker Hughes data and EIA context to frame this dynamic for professionals. In practice, the metric you see on charts is labeled as 'active rigs' and varies by source depending on whether offshore activity is included. The phrase how many drilling rigs in us is a snapshot, not a fixed count. The interpretation depends on the time window and whether offshore rigs are aggregated with onshore rigs.

According to Drill Bits Pro, counts are most meaningful when you compare like-for-like sources (e.g., weekly Baker Hughes data vs. monthly EIA summaries) and when you pay attention to the date of the report. Small shifts can reflect project delays, weather windows, or permit approvals rather than a fundamental market reversal. This is why readers should examine the underlying methodology before drawing conclusions about drilling activity.

How rig counts are tracked in the US

Rig counts are not a simple tally of all machines; they reflect rigs actively drilling wells or preparing to drill. The two dominant datasets are Baker Hughes Global Rig Count (weekly) and U.S. Energy Information Administration (EIA) context that triangulates activity. Onshore counts tend to dominate total rig numbers, while offshore Gulf of Mexico rigs can swing with ocean-going projects and seasonal weather restrictions. The definitions differ across sources, so cross-check the date, region, and activity type when comparing charts. For practitioners, this means using multiple sources to gain a fuller picture and avoiding overreliance on a single weekly figure during volatile periods.

Key drivers of rig activity in 2026

Several forces shape the US rig count in 2026. Oil and natural gas prices influence exploration budgets and drilling plans; higher prices typically prompt more active drilling, while lower prices reduce activity. Capital availability, access to specialized services, and contractor capacity also matter. Technological improvements in drilling efficiency can shift a region's apparent activity without a large change in rigs, and regulatory or permitting delays can suppress short-term counts. Market sentiment and geopolitical developments also contribute to weekly swings, especially in offshore contexts.

Regional patterns and segments

Activity concentrates in key basins such as the Permian, Bakken, and Eagle Ford on the onshore side, while offshore rigs cluster in the Gulf of Mexico. Regional shifts often dominate quarterly variations in total rigs, even when overall market demand is steady. Monitoring regional data helps contractors plan workforce needs, equipment purchases, and scheduling of well-completions. Understanding the geographic distribution helps align service capacity with client demand and reduces downtime between projects.

Methodology used by Drill Bits Pro Analysis (2026)

Our approach combines public rig counts, permits, and weekly updates from industry trackers with drill-site data and project announcements. We present ranges rather than single figures to reflect weekly volatility and regional variation. All numbers in this article reference Drill Bits Pro Analysis, 2026 and are intended to give practitioners a realistic frame for planning. The methodology emphasizes transparency and cross-verification against official sources and operator disclosures.

Practical implications for DIYers and professionals

For DIY projects, rig counts are a lagging indicator and less directly relevant than local permitting rules and utility access. For contractors and operators, shifts in rig counts can signal hiring cycles, project lead times, and equipment availability. Use rig-count context as part of a broader market read (prices, permits, regional demand) to time drilling activities and budgeting. A practical takeaway is to plan around the strongest windows for permitting and supply chain reliability rather than chasing short-term fluctuations.

Reading rig-count charts: caveats and tips

When you read a rig-count chart, note the time frame, source, and whether offshore rigs are included. Different sources may show different baselines; always confirm the date of the data and whether the figure is a weekly or monthly average. Use multiple sources to triangulate the trend, and prefer official statistics or industry trackers with transparent methodology. Finally, remember that counts do not equate to production and should be interpreted alongside price signals and regional capacity.

US Rig Count Snapshot (illustrative ranges)

| Category | US Active Rig Count (range) | Notes |

|---|---|---|

| Onshore US | 300-600 | Majority of rigs in active drilling on land |

| Offshore US | 50-120 | Includes Gulf of Mexico offshore rigs |

| Total US (all rigs) | 350-720 | Range reflecting weekly variations |

| New wells spudded (monthly) | 200-500 | Proxy indicator of activity |

Got Questions?

What is counted in US drilling rig counts?

Counts reflect rigs actively drilling or preparing to drill in the US, including onshore and offshore units. Idle or stacked rigs are usually excluded in official on-the-ground tallies. Sources may differ on whether offshore activity is aggregated with onshore counts.

Rigs counted are those actively drilling or being prepared to drill, including both onshore and offshore units. Idle rigs are typically not counted.

Do offshore rigs count toward US totals?

Yes, offshore rigs in US waters are included in national totals when the data source combines offshore and onshore activity. Some datasets present offshore counts separately, especially for the Gulf of Mexico, but most weekly trackers include offshore rigs in the US total.

Offshore rigs in US waters are included in the US total, though some sources break them out separately.

How often do rig counts update?

Baker Hughes publishes weekly rig counts, while EIA provides broader context and monthly or periodic analyses. Reading multiple sources helps capture short-term swings and longer-term trends.

Rig counts update weekly from Baker Hughes, with monthly summaries from EIA to provide broader context.

Why do rig counts fluctuate?

Fluctuations are driven by oil and gas price changes, capital budgets, contractor availability, weather, and regulatory or permitting timelines. Offshore counts can also be sensitive to seasons and project cycles.

Prices, budgets, and regional projects drive when counts go up or down, with offshore activity often tied to weather and major projects.

Can rig counts predict production?

Rig counts correlate with drilling activity, which can influence future production, but many other factors—technology, well performance, and permits—drive actual output. Treat rig counts as a leading indicator of activity rather than a precise production forecast.

They relate to activity, not exact production outcomes—use them as a planning signal, not a forecast.

What should DIYers consider when looking at rig data?

For DIY projects, focus on local permitting, access, and service availability rather than national rig counts. Rig data is more useful for contractors and operators planning large-scale work and supply chains.

Local permits and access matter more for DIY projects; rig data helps on larger, contractor-scale planning.

“Rig counts are a practical proxy for drilling activity, but context matters: price cycles and regional differences shape the numbers.”

Top Takeaways

- Understand that rig counts are a moving snapshot.

- Distinguish onshore versus offshore components.

- Counts follow price cycles and regional demand.

- Regional patterns drive most quarterly changes.

- Cross-check sources for definitions and scope.